Below market pay given that the average associate works 60hrs a week. Developed Markets and Emerging Markets Private Equity & Venture Capital Index and Selected Benchmark Statistics.

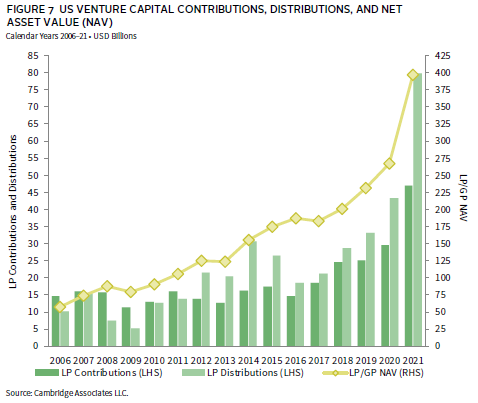

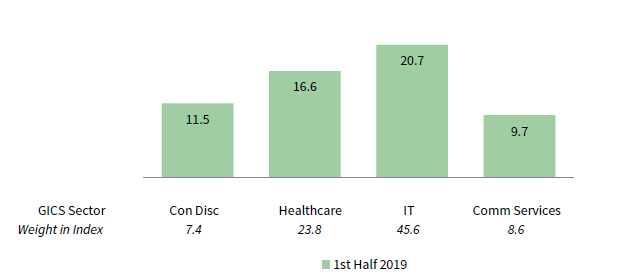

For analysts, its 80% admin (hope you like formatting powerpoint presentations!)/20% investment analysis, and for directors 30% client communication (mostly emails), 50% managing teams of analysts, and 20% actual portfolio management/manager selection. Outside of that, expect years of long hours dealing with mostly administrative tasks. If you're an analyst right out of undergrad, or a director fresh out of MBA, the best way to get promoted fast is to bring in a client. CA Benchmarks via digital feed: Subscribe to up to five fund-level benchmark product families: private equity, venture capital, private credit, real assets, or. Cambridge is very top-heavy, with lots of MDs/partners (who are effectively relationship managers) hired out of banking, HF/PE, or big 4 consulting firms that tend to stick around. At the conclusion of Q4 2020, the Cambridge Associates Australian PE/VC Index represented 30.3 billion raised by 109 PE/VC funds. This is a niche market, and exit opportunities are limited for analysts outside of business school, and as you rise up through the ranks they're limited to pension funds, endowments, or family offices. public market returns 1 US PRIVATE EQUITY: INTERNAL RATES OF RETURN AND MPME PUBLIC MARKET EQUIVALENTS As of DecemSources: Cambridge Associates LLC, Frank Russell Company, Standard & Poors and Thomson Reuters Datastream. REFINITIV VENTURE CAPITAL INDEX APRIL 2023 12800 25600 95 98 01 04 06 09 12 15 17 20 TRVCI Cambridge VC Index Nasdaq Composite 1 ROLLING PERIOD TRVCI Nasdaq Composite TR S&P 500 TR 1 Year-5.84 0.02 2.66 3 Year. The venture capital benchmark was tightly concentrated by sector in the second. Cambridge is a great place to start your career IF you want to go to business school->consulting, go into IR, or if you're very skilled/have a good connection you might be able to get into a HF or PE shop. Venture Capital Index ® gained 6.7 for the second quarter and 11.0 for.

Background: I started as an investment analyst (client-side) 5 years ago.

0 kommentar(er)

0 kommentar(er)